Advisory

From 0 to Scale

I help founders to leap over all the guessing and the messy middle, creating a predictable path to scale.I offer ad-hoc or ongoing 1x1 advisory. My style is direct (yet supportive) and down to the point, which makes each session practical and action oriented. No consulting BS.

From 0 to Scale

I help founders to leap over all the guessing and the messy middle, creating a predictable path to scale.I offer ad-hoc and ongoing 1x1 advisory. My style is direct (yet supportive) and down to the point, which makes each session practical and action oriented. No consulting BS.

Focus areas:

- Strategy & planning

- Fundraising

- Revenues and GTM

- Decision making

- Coaching & mentoring

Focus areas:

- Strategy & planning

- Fundraising

- Revenues and GTM

- Decision making

- Coaching & mentoring

"Ronnie's advice is invaluable. He's been a great resource for me on many fronts."

(Namik Sultan, Founder / GNGR Labs)"Ronnie has been instrumental to our success thus far."

(John Park, Founder / Goodiez)"I am thankful for his guidance and startup domain expertise. Ronnie is a TRUE pro."

(Dave Smith, Founder / The Safe Steps)

"Ronnie's advice is invaluable. He's been a great resource for me on many fronts."

(Namik Sultan, Founder / GNGR Labs)"Ronnie has been instrumental to our success thus far."

(John Park, Founder / Goodiez)"I am thankful for his guidance and startup domain expertise. Ronnie is a TRUE pro."

(Dave Smith, Founder / The Safe Steps)

Fundraising Workshop

A high-impact, two-week, 1x1 workshop to streamline your fundraising, secure capital faster, and minimize setbacks.The process begins with an intensive two-week sprint to craft a high-impact pitch and a targeted fundraising plan, which will will allow you to secure more meetings and avoid "endless loops". Once your raise is live, you’ll receive dedicated coaching - until you secure a term sheet.

A high-impact, two-week, 1x1 workshop to streamline your fundraising, secure capital faster, and minimize setbacks.The process begins with an intensive two-week sprint to craft a high-impact pitch and a targeted fundraising plan, which will will allow you to secure more meetings and avoid "endless loops". Once your raise is live, you’ll receive dedicated coaching - until you secure a term sheet.

Focus areas:

- Fundraising strategy & plan

- Story & pitch deck

- Projections and data room

- Investor outreach

- Investor meetings preparation

- Investor feedback and iterations

Focus areas:

- Fundraising strategy & plan

- Story & pitch deck

- Projections and data room

- Investor outreach

- Investor meetings preparation

- Investor feedback and iterations

Please inquire by clicking below and filling the form.

Please inquire by clicking below and filling the form.

Speaking Engagements

I am available for keynote speaking, panels, fireside chats, and podcasts.

I am available for keynote speaking, panels, fireside chats, and podcasts.

Sample topics:

- Getting from 0 to Scale

- Fundraising strategy and tactics

- Finding product-market-fit

- Bootstrapping & lean executionPlease inquire by clicking below and filling the form.

Sample topics:

- Getting from 0 to Scale

- Fundraising strategy and tactics

- Finding product-market-fit

- Bootstrapping & lean executionPlease inquire by clicking below and filling the form.

Leap

For US and EU Founders

Overview

Leap invests up to $300K in funnel driven startups (B2C, product-led & lead-gen GTM).The program offers two distinct paths for founders:1. Bootstrapping / lean venture path - designed to accelerate revenue and scale with zero (or minimal) funding.2. VC backed path - catalyzing a pre-seed round, driving traction, and orchestrating a Seed round.

Process & Benefits

First check, up to $300K.

Additional capital up to $1M through Leap's network (optional).

Structured, high velocity GTM process to scale revenue from 0 to $100K.

Orchestrating a full Seed round.

The program is fully hands-on. We roll up the sleeves, dive deep, and drive traction. Execution is king.

Bottom Line

Leap is a re-imagined approach for building your startup.If you're a US or EU founder with a big and bold vision, then I'd love to chat.

Reach out through the contact form.

👇

97212 Ventures

For Israeli Founders

97212 Ventures is a next-generation VC and day-one partner for Israeli founders, providing seed capital and insider access to the NYC tech ecosystem.As a founder-driven fund, we provide real access at the earliest stages, enable first major wins and speed up time to market.If you're an early stage Israeli founder, you can apply for funding through our website.

Founder, Leap Ventures

Operating Partner, 97212 Ventures

SVP Product, Innovid (IPO, Acquired)

AVP Product, MediaMind (IPO, Acquired)

MBA, Duke University

LL.B., Tel Aviv Univeristy

About

About

Product Leader Turned VC & Founder PartnerOver the past 20 years, I’ve helped build and scale category-leading companies to over $200M in ARR and $100M in funding. My career includes two journeys from startup to exit, totaling over $2B in corporate exits.I then "crossed the street" to the VC side and joined 97212 Ventures as an Operating Partner, where I saw firsthand how difficult it is even for the most promising founders to move from 0 to scale.Today, I bridge that gap.I partner hands-on with founders to navigate the "Messy Middle," turning a chaotic guessing game into a predictable path forward. I don’t just offer "strategic vision" from a distance; I blend VC-level perspective with the action-driven approach of a seasoned operator.

Operating Partner, 97212 Ventures

Startup Partner, Leap

SVP Products, Innovid (IPO, Acquired)

AVP Product, MediaMind (IPO, Acquired)

MBA, Duke University

LL.B., Tel Aviv Univeristy

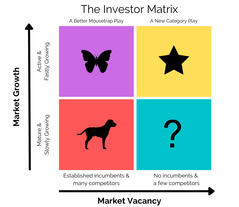

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund -

and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund - and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund -

and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund - and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund -

and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund - and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund -

and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Free eBook

thinking like a vc

An Insider Guide

How Investors Think, Evaluate Startups and Decide to Fund - and What It Means for Founders

Written by an industry insider, this comprehensive guide pulls back the curtain on the often-opaque world of venture capital. It provides rare, behind-the-scenes insights into the internal mechanics of how VCs truly evaluate startups and make high-stakes investment decisions.For any founder planning to fundraise, this book is an essential roadmap to understanding the investor's mind and successfully navigating the capital landscape.A must read.

Contact

Please use this form to inquire about advisory, workshops, speaking engagements, or general collaboration.

Ronnie Lavi

From 0 to Scale

👇

Free e-Book: THINKING LIKE A VC

Learn how investors think, evaluate startups and decide to fund - and What It Means for Founders.

Fundraising, bootstrapping, growth and strategy help

Thank you

Your message has been sent.

You'll hear back from me shortly.

Online Event

The Investor Mindset

The Investor Mindset

An insider look into the behind-the-scenes of VCs perspective, pitch evaluations, and investment decisions.

An insider look into the behind-the-scenes of VCs perspective, startup pitch evaluations, and investment decisions.

VC fundraising can feel like an enigma, a moving target with unclear rules. In this webinar, we'll pull back the curtain and give you a behind-the-scenes look at how investors truly think.As a VC myself, I’ll share the unspoken truths and non-trivial factors that influence investment decisions, insights you won’t find in a typical pitch deck guide.Join me to demystify VC fundraising and put you on the path to a successful raise.Here's what you'll gain:

VC fundraising can feel like an enigma, a moving target with unclear rules. In this webinar, we'll pull back the curtain and give you a behind-the-scenes look at how investors truly think.As a VC myself, I’ll share the unspoken truths and non-trivial factors that influence investment decisions, insights you won’t find in a typical pitch deck guide.Join me to demystify VC fundraising and put you on the path to a successful raise.

Here's what you'll gain:

Learn what VCs are really looking for and how they assess pitches.

Understand the subtle cues that make or break a deal.

Get more responses and better engagement from VCs.

Avoid endless pitches that lead to nowhere.

Ask me anything you'd like in the Q&A.

Online Event

The Investor Mindset

An insider look into the behind-the-scenes of VCs perspective, pitch evaluations, and investment decisions.

A must for any founder who's planning to fundraise. - Alex Boyd

OverviewVC fundraising can feel like an enigma, a moving target with unclear rules. In this webinar, we'll pull back the curtain and give you a behind-the-scenes look at how investors truly think.The Plan

As a VC myself, I’ll share the unspoken truths and non-trivial factors that influence investment decisions, insights you won’t find in a typical pitch deck guide.Join me to demystify VC fundraising and put you on the path to a successful raise.Why Attend?

Here's what you'll gain:

Learn what VCs are really looking for and how they assess pitches.

Understand the subtle cues that make or break a deal.

Get more responses and better engagement from VCs.

Avoid endless pitches that lead to nowhere.

Ask me anything you'd like in the Q&A.

Host

For over 2 decades, Ronnie has played a key role in building and scaling category-leading companies. He has gone from startup to IPO to exit twice (totalling over $2B). Ronnie currently invests and works closely with early-stage startups.

found an error?

Found and Error?

Sorry about that. Please let us know and we'll take care of it right away.

Hands-On Coaching

Get Funded:

From Pitch to Term Sheet

Hands-On Coaching

Get Funded

From Pitch to Term Sheet

All You Need for VC Fundraising

This coaching program is designed to help founders raise capital with more ease and speed while being more efficient and avoiding critical mistakes.Pitch Deck & Fundraising Plan

The program starts with a 2-week period, in which you’ll build a pitch and a plan that speaks directly to investors. We'll then move on to build a custom fundraising plan that puts you in front of the right people, secure more investor meetings, avoid fundraising mistakes, and prevent endless loops with investors.Coaching

Once you're ready to launch your fundraising process, you'll receive ongoing coaching and support as needed until you get a term sheet. This includes weekly meetings, as well texts and emails as needed. We'll focus on getting you prepared and improving based on results and feedbackWhy Join?

By joining the program you’ll save time, reduce friction in your process, and increase your chances of closing a successful round.

" Ronnie's guidance on fundraising and strategic planning is invaluable. "

Namik Soltan, Founder

Program Details

Benefits

Develop a strong pitch that speaks the investor’s language and portrays a compelling opportunity.

Develop a fundraising strategy and process that uses the 'wave' framework, putting you in front of your desired investors at the best time.

Get investors' attention and secure meetings with more of them.

Learn how to engage investors to avoid cold pitches.

Cut down on the number of meetings required to get to a check.

Limit costly mistakes and avoid endless fundraising loops with investors.

Schedule

| Session # | Duration | Topic |

|---|---|---|

| 1 | 1.5 hrs | Story Line: The insight, audience, problem & solution |

| 2 | 1.5 hrs | Story Line 2: TAM, GTM, Traction, Projections, Team |

| 3 | 1 hr | 1:1 full deck review |

| 4 | Async | Offline deck iterations via email or Loom |

| 5 | 1 hr | Fundraising planning: overview, discussion, draft plan |

| 6 | 30min | 1:1 fundraising plan review |

| 7 | Ongoing | Going Live! - fundraising support before and after VC pitches |

What you'll get

4 online live sessions including frontal presentation, exercises, guided discussions, Q&A.

2 dedicated 1x1 private sessions to review your pitch deck and fundraising plan.

Support via email/whatsapp in between sessions.

A small forum of up to 10 like-minded founders and a safe space to engage with, discuss, ask questions.

Templates and tools.

Ongoing support and coaching via meetings, calls, whatsapp, and emails, until you raise your round.

Your Instructor

For over 2 decades, Ronnie has played a key role in building and scaling category-leading companies. He has gone from startup to IPO to exit twice (totalling over $2B). Ronnie currently invests and works closely with early-stage startups.

Get Funded

Don't leave your fundraising success to luck. Join other founders getting insider advice, tips and behind the scenes VC insights.

Don't leave fundraising success to luck.Join other founders getting insider advice, tips and behind the scenes VC insights.

Sign up to unlock the VC black box.

Favorably reviewed

Welcome

Demystifying VC Fundraising

Hi, I'm Ronnie Lavi.

I level the fundraising playing field for founders.

Unmasking the hidden VC rules.VC fundraising is an elusive, vague process. It's a "black box."There's a complete information asymmetry:VCs hold back info. They offer vague investment criteria, laconic feedback and zero visibility into internal dynamics.On the other hand, Founders need to share everything: pitch deck, historical data, bank statements, etc.Founders are in a complete disadvantage while playing a guessing game.Now, top that with a lengthy and unpredictable process that can take months.It's painful.As a former VC, I sat across the table and saw the founders' struggle firsthand. I decided to change it by creating unparalleled transparency and sharing the essential insights held back by VCs and unspoken by others.This level of transparency will level the playing field for founders.

Start Here

Get Funded Newsletter

Weekly insights from behind the VC scenes

Dive Deeper

Additional Resources

Webinar

Cracking the VC Code

An insider look into the behind-the-scenes of VCs perspective, pitch evaluations, and investment decisions.Join me to demystify VC fundraising and get on the path to a successful raise.

eBook

The Investor Mindset

Learn how early stage investors think and how they evaluate investment opportunities. A must read for every startup founder.Get your free copy.

No more guessing

Real candid insights

Complete transparency

Knowledge For running a smarter and fairer raise.

Sign up to take control and raise with confidence.

Reviews

What Founders Say

"Ronnie's advice is invaluable. He has been a great resource for me on multiple fronts such as fundraising, making strategic intros and overall planning."

Namik Soltan, GNGR Labs

"Ronnie has been instrumental to our success thus far, providing strategic guidance, facilitating our user acquisition plan and adjusting our product roadmap."

John Park, Goodiez

"Working with Ronnie has been an incredibly enriching experience. I am thankful for his guidance and startup domain expertise. Ronnie is a TRUE pro."

Dave Smith, The SAFE Steps

Bio

About Me

I am the Founder of Leap, a 0-to-Seed incubation program.Prior to Leap, I served as an Operating Partner at 97212 Ventures, a pre-Seed and Seed-stage VC firm. Before crossing the table to the VC side, I spent more than two decades on the startup side, helping build and scale category-leading companies. I’ve gone from startup to exit twice — through both IPO and acquisition — totaling more than $2 billion in outcomes.Through Leap, I continue to work closely with early-stage startups.During my time as a VC partner, I saw firsthand how disadvantaged founders are throughout the fundraising process. The lack of transparency, clear expectations, and candid guidance was painful to witness.I started Leap to change that — to level the playing field and give founders the clarity and support they need to succeed.